Download FIFA 16 Mod FIFA 23 Apk Obb Data which has been tweaked to work fully offline on Android device.

Table of contents

Best Car Insurance for Young Drivers

Introduction

As young drivers venture onto the roads, it's crucial for them to have proper car insurance coverage. The journey towards finding the best car insurance can be overwhelming, especially for those starting out with limited driving experience. In this article, we will explore the challenges faced by young drivers, the importance of car insurance, factors to consider when choosing a policy, the best insurance companies for young drivers, and valuable tips to find affordable coverage.

Understanding the Challenges for Young Drivers

Understanding the Challenges for Young Drivers

Young drivers encounter unique challenges when it comes to car insurance. Insurance providers consider factors such as age, gender, location, and driving history when calculating premiums. Due to their limited experience, young drivers are often deemed higher-risk by insurers, resulting in higher insurance rates. It's important for young drivers to be aware of these challenges and find ways to navigate the insurance market effectively.

Importance of Car Insurance for Young Drivers

Car insurance is not only a legal requirement but also offers crucial protection for young drivers. Accidents can happen to anyone, regardless of age or experience. Car insurance provides financial coverage for damages to your vehicle, medical expenses, and liability protection if you are at fault for an accident. Without insurance, young drivers may face significant financial burdens in the event of an accident.

Factors to Consider When Choosing Car Insurance for Young Drivers

When selecting car insurance for young drivers, it's essential to consider various factors to ensure optimal coverage. Here are some key considerations:

1. Coverage Options

Evaluate the coverage options provided by different insurance companies. Look for policies that offer comprehensive coverage, including liability, collision, and comprehensive coverage. Additionally, consider options like uninsured/underinsured motorist coverage and medical payments coverage.

2. Cost Considerations

Compare the cost of insurance premiums from different companies. While affordability is important, it's crucial to balance it with the coverage provided. Look for companies that offer competitive rates for young drivers while still offering adequate coverage.

3. Reputation and Customer Service

Research the reputation and customer service of insurance companies. Look for companies that have a good track record in handling claims efficiently and providing excellent customer service. Online reviews and ratings can provide valuable insights into the customer experience.

Best Car Insurance Companies for Young Drivers

Now, let's explore some of the best car insurance companies catering to young drivers:

1. Erie Insurance

Erie Insurance is known for its competitive rates and excellent customer service. They offer a range of coverage options tailored for young drivers, including liability, collision, comprehensive, and medical payments coverage. With a focus on personalized service, Erie Insurance ensures that young drivers receive the support they need throughout their insurance journey.

Erie Insurance operates in 12 states across the Mid-Atlantic and Midwest regions of the United States, including Illinois, Indiana, Kentucky, Maryland, New York, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia, Wisconsin, and the District of Columbia.

2. USAA

USAA (United Services Automobile Association) is widely recognized for its exceptional customer service and dedication to serving members of the military and their families. USAA provides comprehensive coverage options specifically designed for young drivers. They offer competitive rates, discounts, and flexible policy terms. However, it's important to note that USAA membership is limited to military personnel and their eligible family members.

3. American Family Insurance

American Family Insurance is committed to providing tailored coverage options for young drivers. They offer a range of discounts and incentives, such as good student discounts and safe driving rewards programs. With a strong presence across the United States, American Family Insurance serves customers in 19 states, including Arizona, Colorado, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Minnesota, Missouri, Nebraska, Nevada, North Dakota, Ohio, Oregon, South Dakota, Utah, Washington, and Wisconsin.

4. Nationwide

Nationwide Insurance is a reputable provider that offers comprehensive coverage options for young drivers. They focus on providing affordable insurance solutions without compromising on quality. Nationwide operates throughout the United States, serving customers in all 50 states.

5. Auto-Owners

Auto-Owners Insurance is known for its excellent customer service and competitive rates. They offer a variety of coverage options suitable for young drivers, including liability, collision, comprehensive, and additional coverage options. Auto-Owners Insurance operates in 26 states across the United States, including Michigan, Ohio, Indiana, Illinois, Wisconsin, Minnesota, Iowa, Missouri, Kansas, Nebraska, South Dakota, North Dakota, Pennsylvania, Virginia, North Carolina, South Carolina, Georgia, Tennessee, Alabama, Mississippi, Arkansas, Florida, Colorado, Arizona, Utah, and Idaho.

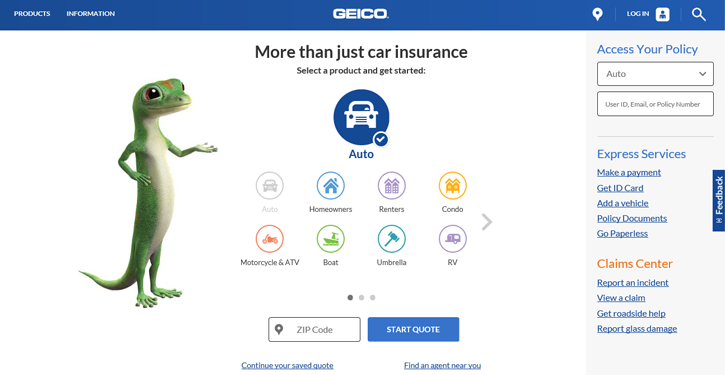

6. Geico

Geico is a popular choice for young drivers due to its competitive rates and user-friendly online platform. They offer a wide range of coverage options, including liability, collision, comprehensive, and additional coverage choices. Geico operates nationwide, providing coverage in all 50 states and the District of Columbia.

7. Travelers

Travelers Insurance is known for its flexible coverage options and extensive network of agents. They offer customizable policies suitable for young drivers, ensuring they have the coverage they need. Travelers operates in all 50 states, allowing young drivers nationwide access to their insurance products and services.

Tips for Finding Affordable Car Insurance for Young Drivers

Finding affordable car insurance as a young driver may seem challenging, but it's not impossible. Here are some tips to help you in your search:

1. Good Student Discounts

Many insurance companies offer discounts for young drivers who demonstrate good academic performance. Maintain good grades to qualify for these discounts and potentially lower your insurance premiums.

2. Defensive Driving Courses

Completing a defensive driving course can not only improve your driving skills but also make you eligible for discounts on your car insurance. Check with insurance providers to see if they offer discounts for completing recognized defensive driving programs.

3. Choosing the Right Car

The type of car you drive affects your insurance rates. Opt for a car with safety features, good crash-test ratings, and a moderate price tag. Avoid high-performance or luxury vehicles that generally come with higher insurance costs.

4. Increasing Deductibles

Consider increasing your deductibles to lower your insurance premiums. However, ensure that you can comfortably afford the deductible amount in the event of a claim.

Conclusion

Finding the best car insurance for young drivers requires careful consideration of various factors, including coverage options, cost, and reputation. By exploring the insurance companies mentioned, such as Erie Insurance, USAA, American Family Insurance, Nationwide, Auto-Owners, Geico, and Travelers, young drivers can make informed decisions about their insurance needs. Additionally, implementing tips like good student discounts, defensive driving courses, selecting the right car, and increasing deductibles can help young drivers find affordable coverage without compromising on protection.

FAQs

1. What is the average cost of car insurance for young drivers?

The average cost of car insurance for young drivers varies based on several factors, including age, driving history, location, and the insurance company. Young drivers generally face higher insurance rates due to their limited driving experience and perceived higher risk. It's recommended to obtain quotes from multiple insurance providers to get a more accurate idea of the cost.

2. Can young drivers get discounts on car insurance?

Yes, young drivers can qualify for various discounts on car insurance. Some common discounts include good student discounts, safe driving discounts, completion of defensive driving courses, and being listed on a parent's policy. It's important to inquire about available discounts when obtaining insurance quotes.

3. Is it better to add a young driver to a parent's policy or get separate insurance?

The decision to add a young driver to a parent's policy or get separate insurance depends on individual circumstances. Adding a young driver to a parent's policy can often be more cost-effective. However, it's advisable to compare quotes for both options and consider factors such as coverage needs, premiums, and potential limitations.

4. Are there any specialized car insurance options for young drivers?

Yes, some insurance companies offer specialized car insurance options tailored specifically for young drivers. These options may include additional discounts, programs for safe driving, and resources for improving driving skills. Research and inquire with insurance providers to explore specialized options.

5. How can young drivers improve their car insurance rates?

Young drivers can improve their car insurance rates by maintaining a clean driving record, completing defensive driving courses, maintaining good academic records, and choosing a car with good safety ratings. Additionally, comparing quotes from multiple insurance companies and exploring available discounts can help young drivers find more favorable rates.