FIFA 16 Mod FIFA 23 Apk + Obb+ Data Offline is a soccer game that allows you to play soccer matches on your mobile phone. It is an upgraded version of FIFA 16 with the latest features and player transfers. The game has all the features that you expect from a soccer game, including realistic graphics, animations, and sound effects.

Table of contents

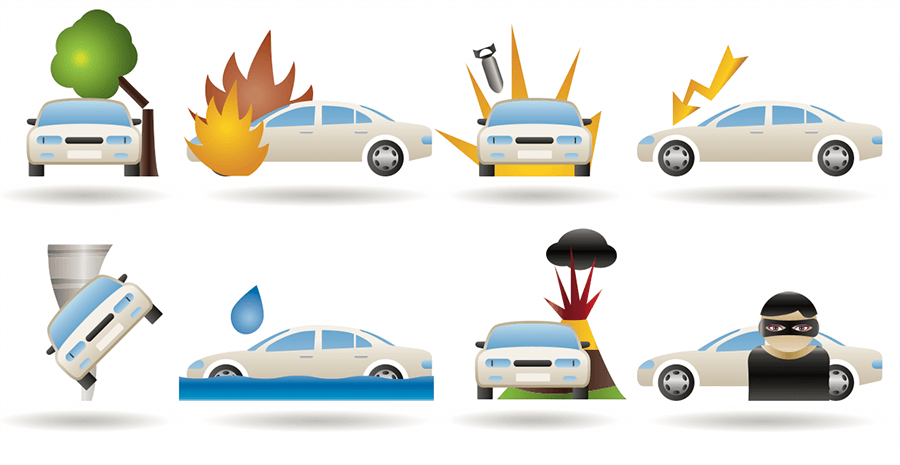

Insurance Quote for a Car: Protecting Your Vehicle and Your Finances

insurance is an essential aspect of responsible car ownership. Not only does it protect your vehicle, but it also ensures that you are financially secure in case of accidents or damage. However, finding the right insurance quote for your car can be a daunting task. This article aims to provide a comprehensive guide on how to obtain an insurance quote for a car, factors that affect the quotes, types of coverage, and tips to find affordable options.

Importance of Car Insurance

Importance of Car Insurance

Protecting Your Vehicle

Car insurance safeguards your vehicle from unforeseen circumstances such as accidents, theft, or natural disasters. It provides financial coverage for repairs or replacement, ensuring that you can get back on the road without a significant financial burden.

Covering Medical Expenses

Accidents can lead to injuries, and car insurance helps cover medical expenses for yourself and others involved in the accident. This coverage ensures that you can receive proper medical treatment without incurring exorbitant costs.

Meeting Legal Requirements

Car insurance is a legal requirement in most jurisdictions. Driving without insurance can lead to severe penalties, including fines and license suspension. Having the right insurance coverage allows you to comply with the law and avoid legal complications.

Factors Affecting Car Insurance Quotes

Several factors influence the cost of car insurance quotes. Insurance providers take these factors into account to assess the level of risk associated with insuring a particular vehicle and driver. Some of the common factors include:

Vehicle Type and Age

The make, model, and age of your vehicle play a significant role in determining your insurance premium. Expensive or high-performance cars tend to have higher premiums due to their higher repair costs. Additionally, older vehicles might have a higher risk of mechanical failure, leading to increased premiums.

Driving History

Your driving history, including past accidents, traffic violations, and claims, can impact your insurance quotes. Drivers with a clean record often enjoy lower premiums, as they are considered lower risk. On the other hand, drivers with a history of accidents or violations may face higher insurance costs.

Location

The area where you live can affect your car insurance quotes. Urban areas with higher traffic density and crime rates may lead to increased premiums. Additionally, areas prone to natural disasters may also result in higher insurance costs.

Coverage Limits and Deductibles

The coverage limits and deductibles you choose also affect the insurance quote. Higher coverage limits and lower deductibles typically result in higher premiums. It is essential to strike a balance between adequate coverage and affordability.

Types of Car Insurance Coverage

Car insurance is a vital protection for drivers that provides coverage for various types of risks and incidents. Understanding the different types of car insurance coverage available is essential to ensure you have the appropriate level of protection. Let's explore the most common types of car insurance coverage:

Liability Insurance: Protecting Yourself from Financial Liability

Liability insurance is a fundamental component of car insurance that helps protect you from financial liability in the event of an accident where you are at fault. It includes two main types of coverage:

-

Bodily Injury Liability: This coverage pays for the medical expenses, rehabilitation costs, and lost wages of the other party involved in the accident if you are found responsible for their injuries. It also covers legal fees if you are sued for the accident.

-

Property Damage Liability: This coverage provides financial protection for the damage caused to someone else's property as a result of the accident. It can include damage to their vehicle, other structures, or any other property affected by the collision.

Liability insurance is not only crucial for protecting your personal finances but is also a legal requirement in most jurisdictions. It ensures that you meet your legal obligations as a driver and provides a safety net against substantial financial burdens.

Collision Insurance: Safeguarding Your Vehicle against Collisions

Collision insurance is a type of car insurance coverage that protects your own vehicle in the event of a collision, regardless of who is at fault. It covers the repair or replacement costs of your vehicle if it is damaged due to a collision with another vehicle or object, or if it rolls over.

Having collision insurance provides financial protection and ensures that you can repair or replace your vehicle without bearing the entire cost out of your own pocket. This coverage is particularly important for newer or more valuable vehicles.

Collision insurance typically requires you to pay a deductible before the coverage kicks in. The deductible is the amount you are responsible for paying out of pocket. Higher deductibles often result in lower premiums, while lower deductibles increase the premium amount.

Comprehensive Insurance: Protection Beyond Collisions

Comprehensive insurance provides coverage for damages to your vehicle that are not caused by collisions. It protects your vehicle from a wide range of risks, including theft, vandalism, natural disasters, falling objects, fire, and damage caused by hitting an animal.

Comprehensive insurance offers broader coverage than collision insurance, ensuring that you are protected against non-collision incidents that can cause significant damage to your vehicle. It provides financial security in situations beyond your control, such as theft or damage caused by severe weather conditions.

Similar to collision insurance, comprehensive coverage also requires you to pay a deductible. The deductible amount can be chosen based on your preference and affordability.

Personal Injury Protection: Ensuring Financial Security for You and Your Passengers

Personal Injury Protection (PIP) coverage is designed to provide financial protection for you and your passengers in the event of an accident. PIP covers medical expenses, lost wages, and other related costs, regardless of fault.

PIP coverage goes beyond the traditional liability insurance, which only covers injuries sustained by others in an accident. With PIP, you and your passengers are protected, ensuring that necessary medical treatment and related expenses are covered.

PIP coverage often includes benefits such as coverage for medical expenses, rehabilitation costs, lost wages, and even funeral expenses. The specific benefits and coverage limits can vary depending on your policy and state regulations.

Uninsured/Underinsured Motorist Coverage: Protection Against Uninsured Drivers

Uninsured/Underinsured Motorist (UM/UIM) coverage provides protection in case you are involved in an accident with a driver who either does not have insurance or has inadequate insurance coverage. This coverage ensures that you are financially protected even if the at-fault driver cannot cover the expenses.

UM/UIM coverage consists of two parts: uninsured motorist coverage and underinsured motorist coverage. Uninsured motorist coverage applies when you are involved in an accident with a driver who does not have any insurance. Underinsured motorist coverage comes into play when the at-fault driver has insurance, but their coverage limits are insufficient to cover your expenses fully.

Having UM/UIM coverage is crucial because not all drivers carry adequate insurance or any insurance at all. If you are involved in an accident with an uninsured or underinsured driver, this coverage ensures that your medical expenses, lost wages, and other related costs are covered.

In conclusion, having the right car insurance coverage is essential for protecting yourself, your vehicle, and others on the road. Liability insurance safeguards you from financial liability, collision insurance covers damages to your vehicle in collisions, comprehensive insurance provides protection against non-collision incidents, personal injury protection covers medical expenses and related costs, and uninsured/underinsured motorist coverage ensures you are protected when involved in an accident with an uninsured or underinsured driver. Understanding these types of coverage allows you to make informed decisions about your car insurance needs.

How to Get an Insurance Quote for a Car

When looking for an insurance quote for your car, it's essential to follow a systematic approach to ensure you find the right coverage at a reasonable price. Here are the steps to help you through the process:

Research Insurance Providers

Start by researching reputable insurance providers in your area. Look for companies with a good reputation, positive customer reviews, and competitive rates. Consider factors such as financial stability and customer service when evaluating potential insurers.

Provide Accurate Information

When requesting a quote, provide accurate and complete information about yourself, your vehicle, and your driving history. Any inaccuracies may lead to incorrect quotes or potential issues when filing a claim in the future. Be transparent and honest to receive accurate estimates.

Compare Quotes

Obtain quotes from multiple insurance providers to compare prices, coverage options, and customer reviews. Use online comparison tools or consult with independent insurance agents to get a comprehensive view of available options. Compare the coverage limits, deductibles, and additional features of each quote.

Review Policy Details

Carefully review the policy details of each quote you receive. Understand the coverage limits, exclusions, and any additional features or riders. Ensure that the policy meets your specific needs and offers sufficient protection for your vehicle and personal circumstances.

Ask Questions

Do not hesitate to ask questions to clarify any doubts or uncertainties. Contact the insurance providers directly and seek clarification on any policy terms, coverage details, or premium calculations. A good insurance company will be transparent and happy to assist you.

Tips for Finding Affordable Car Insurance Quotes

Finding affordable car insurance quotes requires some proactive steps on your part. Consider the following tips to potentially reduce your insurance premiums:

Maintain a Good Driving Record

A clean driving record with no accidents or violations demonstrates responsible driving behavior. Insurance companies often reward such drivers with lower premiums. Focus on safe driving habits and adhere to traffic rules to maintain a good record.

Choose a Higher Deductible

Opting for a higher deductible can lower your insurance premiums. However, be sure to choose a deductible that you can comfortably afford in case of an accident or damage. Consider your financial situation and the value of your vehicle when deciding on a deductible amount.

Bundle Insurance Policies

Many insurance companies offer discounts if you bundle multiple policies, such as car insurance and homeowner's insurance, with them. Consolidating your insurance needs with a single provider can lead to cost savings.

Look for Discounts

Inquire about available discounts when obtaining insurance quotes. Insurers often provide discounts for various factors such as safe driving courses, anti-theft devices, multiple cars on the same policy, or low mileage. Take advantage of these discounts to reduce your premiums.

Pay Annually

If financially feasible, consider paying your car insurance premium annually instead of monthly or quarterly. Many insurance companies offer a discount for upfront annual payments, which can result in overall cost savings.

Common Mistakes to Avoid when Getting Insurance Quotes

While obtaining car insurance quotes, be mindful of the following common mistakes to ensure you make an informed decision:

Providing Inaccurate Information

To receive accurate quotes, it is crucial to provide honest and accurate information about your vehicle, driving history, and personal details. Misrepresenting information can lead to incorrect quotes and potential issues when filing claims.

Not Reviewing Policy Exclusions

Carefully review the policy exclusions to understand what is not covered by your insurance. Be aware of any specific conditions, limitations, or restrictions that may impact your coverage. Understanding the exclusions helps you avoid surprises and make informed decisions.

Ignoring the Fine Print

It is essential to read and understand the policy terms and conditions before finalizing your insurance purchase. Pay attention to details such as coverage limits, deductibles, claim procedures, cancellation policies, and renewal terms. Ignoring the fine print may lead to misunderstandings or disputes later on.

Overlooking Additional Coverage Options

Consider additional coverage options that may be beneficial for your specific circumstances. For example, if you have a long commute, roadside assistance coverage might be useful. Evaluate your needs and explore the availability of additional coverage beyond the basic requirements.

Focusing Solely on Price

While affordability is important, it is equally crucial to consider the coverage, reputation, and customer service of the insurance provider. Cheaper premiums may come with trade-offs in terms of coverage or customer support. Strive to strike a balance between price and quality.

Conclusion

Obtaining an insurance quote for a car is a vital step in protecting your vehicle and your financial well-being. By understanding the factors that affect insurance quotes, types of coverage, and taking proactive steps to find affordable options, you can secure the right insurance policy. Remember to review policy details, ask questions, and avoid common mistakes during the process. By doing so, you can drive with peace of mind, knowing that you are adequately protected.

FAQs

-

What is the minimum car insurance coverage required? The minimum car insurance coverage requirements vary depending on your jurisdiction. It is essential to check the legal requirements in your area to ensure compliance.

-

Can I get a car insurance quote without personal information? To receive accurate quotes, insurance providers typically require some personal information, such as your age, driving history, and vehicle details. However, you can limit the information shared and still obtain a quote.

-

How often should I review my car insurance policy? It is recommended to review your car insurance policy annually or whenever significant life events occur, such as buying a new car, moving, or changes in your driving habits.

-

Will my insurance rates increase if I file a claim? Filing a claim can potentially result in increased insurance rates. However, the impact varies depending on factors such as the nature of the claim, your driving history, and the insurance provider's policies.

-

Can I change my coverage limits after getting a quote? Yes, you can typically adjust your coverage limits even after receiving a quote. Contact your insurance provider to discuss any desired changes and understand their specific procedures for making adjustments.

Available Versions of FIFA 16 Mod FIFA 23 UCL Apk + Obb+ Data Offline Download

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.